Pareto Securities has worked closely with the Norwegian Savings bank sector for many years and have both had a wide coverage and facilitated a majority of the transactions in the sector. There are currently 89 savings banks in Norway, of which 27 is listed at the stock exchange. Pareto Securities Equity Research covers 12 of the largest and most liquid banks and 9 of these banks presented themselves at the seminar.

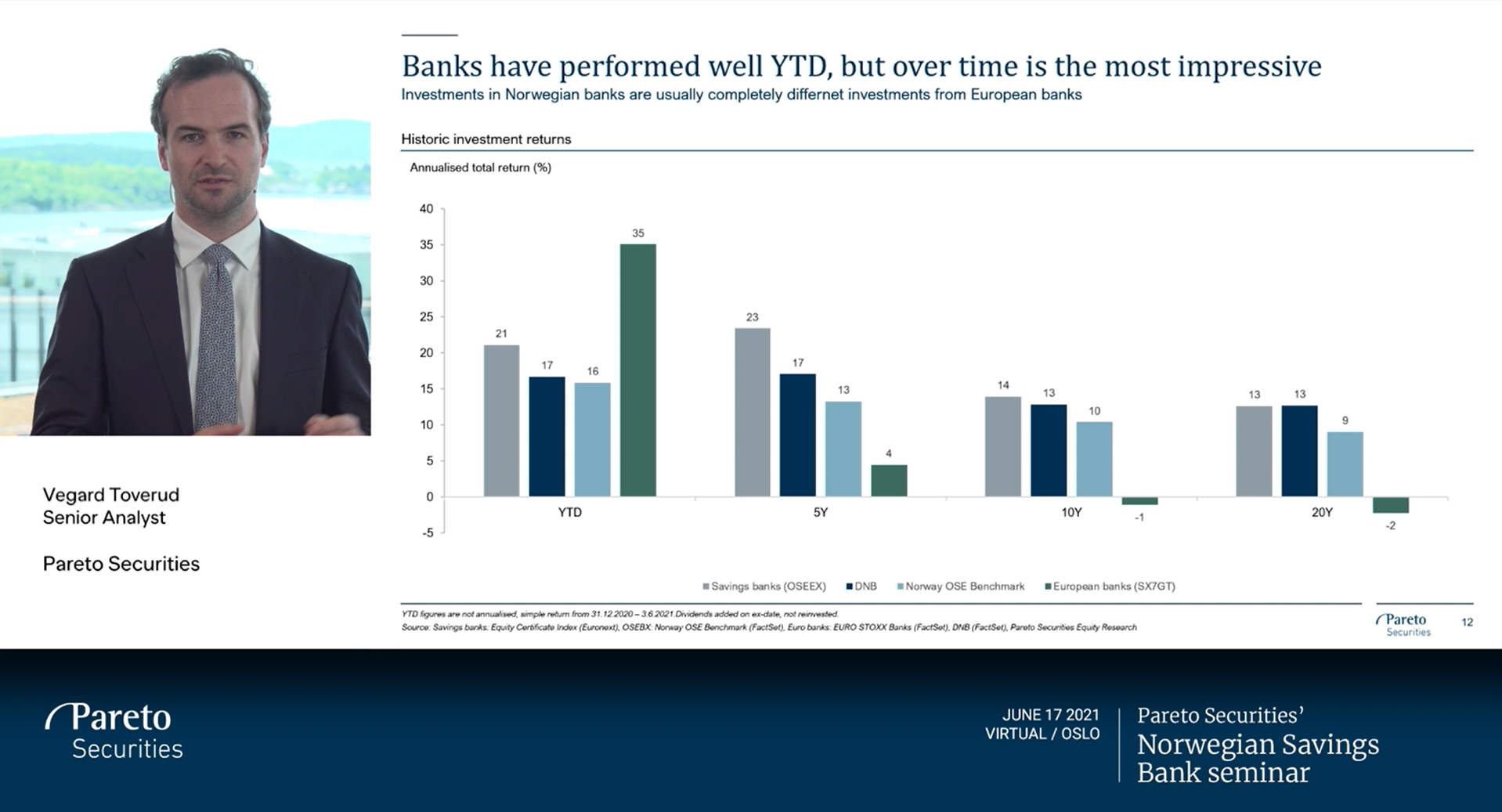

Most of these banks generally only present themselves to a domestic audience in Norwegian. However, the performance of the equity certificates has been stellar, outperforming not only European banks in general but also the Norwegian equity market. As such, the seminar offered an interesting opportunity for foreign investors.

Increased inflation and increased interest rate expectations are current trends that support the investment cases for the banks. In addition to discussing the outlook for margins, the banks’ presentations also focused on initiatives to maintain and improve their cost positions. The credit quality in the banks are good and generally the banks were upbeat on credit quality going out of Covid-19. The banks are very well capitalised both compared to national regulations and international peers. Some of the banks touched upon the current overcapitalisation and their capital distribution strategies going forward.

To access the presentations, please use this link.