It has been very hard to beat the stock market without being invested in technology stocks.

Christian Jomaas, Group CEO at Pareto Securities

The technology sector has faced its challenges in recent years, shaped by higher interest rates, changing capital flows and geopolitical concerns. But this trend is now shifting. Global equity markets, with technology as one of its drivers, have delivered strong returns over the past year, with the Nasdaq rising 23 percent.

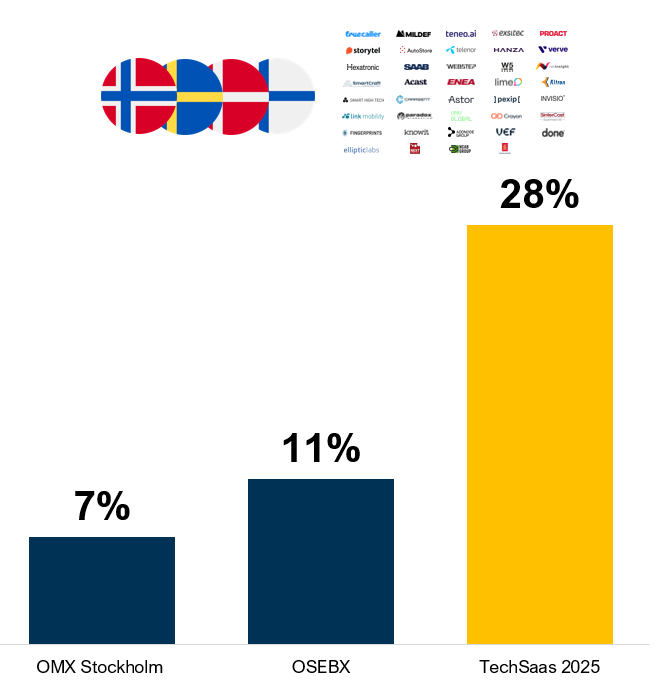

"It has been very hard to beat the stock market without being invested in technology stocks. The Nordics are no exception. Since the last TechSaaS Conference, the group of Nordic tech companies presenting here today has outperformed the broader Nordic market, up 28 percent", Christian Jomaas said during the opening of the Nordic TechSaaS Conference.

This renewed strength in the Nordic tech sector is supported by improving fundamentals: rates are falling in Sweden and Norway, active funds are seeing net inflows, and the gap between public and private valuations is narrowing.

It has been very hard to beat the stock market without being invested in technology stocks.

Christian Jomaas, Group CEO at Pareto Securities

Earlier this year, tariff discussions created uncertainty across global markets. But this also triggered something else: a shift in how investors allocated capital.

“Europe decided to fight back – not with words, but with investments. In 2023, 78 percent of the military equipment purchased by European countries came from outside Europe, but the EU is now shifting course. Massive capital is being directed toward defence, bringing production back to Europe and strengthening strategic autonomy. These initiatives will significantly benefit European, and particularly Nordic defence and technology companies,” Anton Wester said at the Nordic TechSaaS Conference.

In 2023, 78 percent of the military equipment purchased by European countries came from outside Europe, but the EU is now shifting course.

When summarizing the direction of the tech sector, Anton Wester highlighted three central questions:

On the first question, recent performance gives a clear indication. Sentiment indicators and risk appetite are improving with TMT valuations below historical averages. Combine falling rates and rising optimism, with valuations below average, and you get the perfect mix for small-cap outperformance.

The same trend can be seen in trading activity, with volumes on Nasdaq First North up 57 percent year-on-year.

“Liquidity is the oxygen for small-cap markets, and we see it returning. Risk appetite is back – average tail demand in our transactions has increased by 76 percentage points year-on-year. Investors are again chasing growth stories,” Anton Wester said.

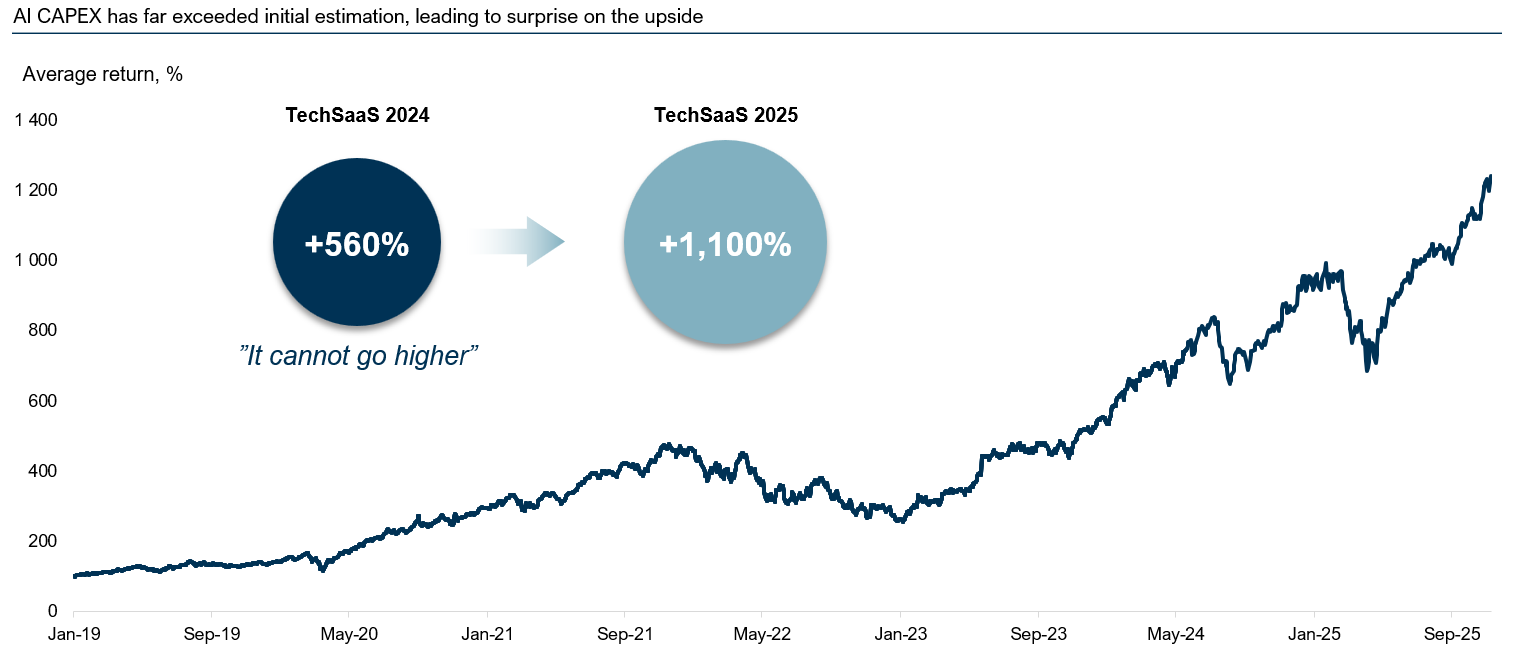

Turning to the third question – the AI race – it is described as a sector that outperforms expectations.

“The most common phrase we heard at last year’s TechSaaS Conference was ‘it cannot go higher’, yet the index continues to climb. AI infrastructure companies have delivered up to +1,100 percent total returns since 2019,” he said.

AI infrastructure companies have delivered up to +1,100 percent total returns since 2019.

As AI adoption accelerates globally, the same trend is evident in the Nordic markets, with an ecosystem of Nordic AI companies having successfully raised capital at a valuation exceeding SEK 1 billion and scaling their products globally.

This year’s keynote speaker at the Nordic TechSaaS Conference, Lovable, highlighted how AI is playing an increasingly central part in the tech sector. As one of the fastest-growing software companies ever, Lovable demonstrated its product live on stage and described its rapid growth journey.