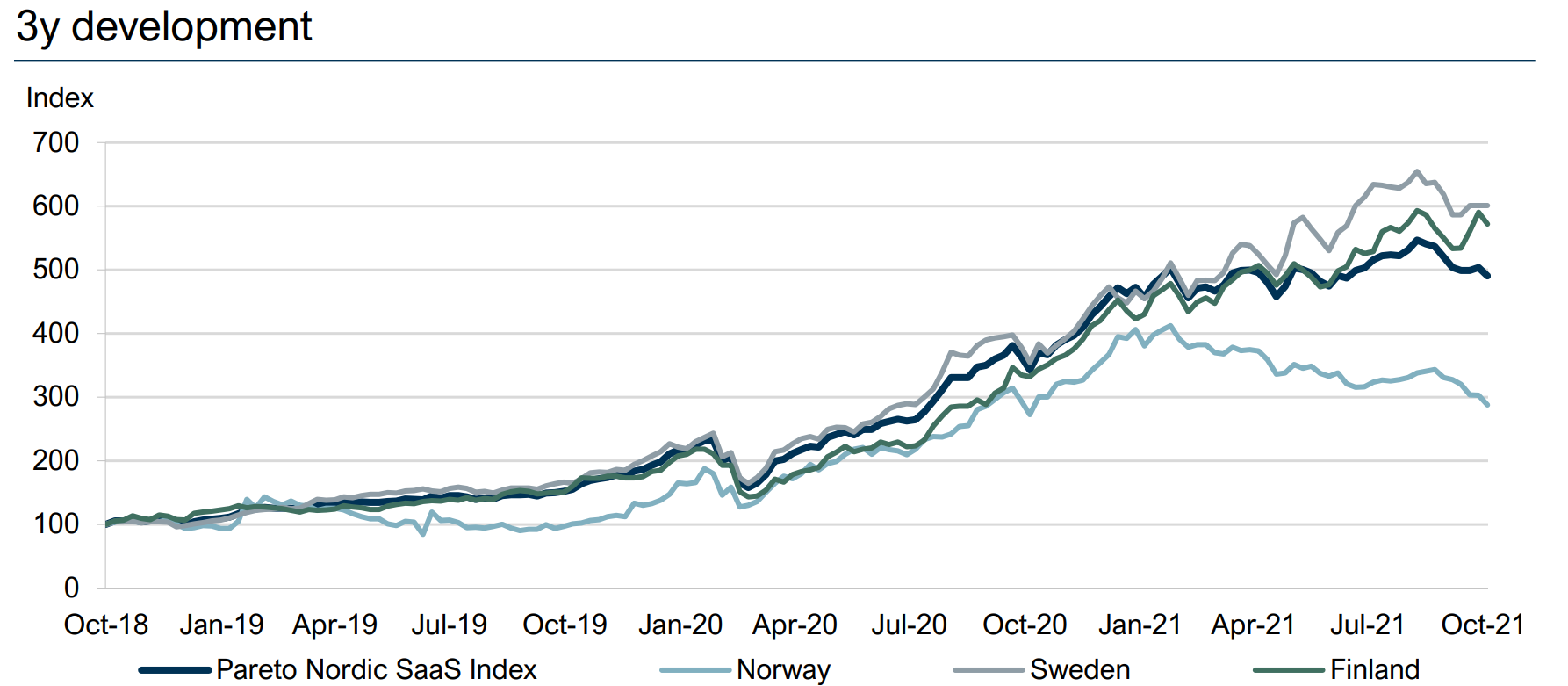

We have seen a valuation gap between Nordic countries, where the Swedish SaaS companies have generally come out on top. We also see a valuation gap between profitable and non-profitable companies compared to one year ago. The sector has come down from the highs of earlier, but it’s important not to forget that the most of these companies still deliver high profitable growth. I see the situation more as a bump in the long road to digitalization and an opportunity to pick some fundamentally strong companies that have unfairly followed the recent negative trend, says Fredricsson.

Software-as-a-Service

The technology subsector Software-as-a-Service, or SaaS, was recently estimated to grow to $145 billion by 2022. SaaS companies are highly scalable as they offer their software through subscription plans and cloud-based solutions. This business model gives an up-front cash flow funding further growth and is often rewarded with a very high customer loyalty. Senior tech analyst Fridtjof Semb Fredricsson emphasizes five key characteristics that set SaaS apart from most other industries;

(1) A software solution often includes low up-front capex needs, (2) online services and products are highly scalable, (3) subscription models make for predictable revenue streams (ARR), (4) high fixed cost base lays the fundament for rapid margin expansion, and (5) working capital works as a funding channels as customers pay upfront.

The 2021 headwind

Tech has been one of the best-performing industries in the stock market, and the Nordics are no exception. The Pareto Nordic SaaS Index, which consists of nearly 50 listed Nordic SaaS companies, is up around 390% the last three years. However, the sector is not without its headwinds. From the all-time highs around February 2021, Norwegian SaaS companies have fallen an average of 30 percent, whereas Swedish SaaS stocks have continued higher. Higher interest rates, a few profit warnings, and a wider sector rotation from growth to value stocks has taken its toll on some Norwegian equities.

A clearer picture of evolution and growth: Keeping track of sector performance down to the details combined with a steadily rising investor interest was the driver behind Fredricsson and the tech team’s newest brainchild; the first ever Nordic SaaS stock index: Pareto Nordic SaaS Index.

Growth strategies in the digital space

Nordic companies are well positioned for continued success in the digital transition, and Anton Wester, partner at Pareto Securities, believes that the Nordic IT Infrastructure is key. The fiber and internet penetration in Sweden and Norway, at 62 and 51 percent, respectively, while Germany and the UK are only around 5 percent.

The Nordic countries are digitally advanced, have an entrepreneurial drive and a risk-taking financial market. The combination is breeding a wide range of high-growth European leaders, says Tarjei Mellin-Olsen, partner at Pareto Securities.

Expansion of operations and growth strategies are particularly relevant for Nordic SaaS and technology companies now. Key challenges the companies are facing is the question of where and how to grow. We will be addressing this and many other questions on our annual Nordic TechSaaS Conference November 10-11, 2021.

We look forward to following the sector growing out of the Nordics and into the wider European and international markets.